Choctaw Casino WinLoss or Tax Information free printable template

Show details

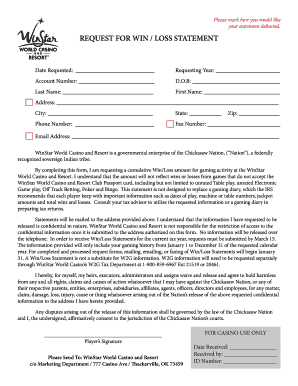

Please Return form to Choctaw Casino Attention Cage Accounting 3400 Choctaw Rd Pocola Ok 74902 Phone 918-436-7761 Fax 918-436-7606 Win/Loss or Tax Information Request Form Name / Players Club Card Last Name First Name Social Security Number Date of Birth Month Mailing Address Day Year Street Address or P. O. Box Apartment Number City State Telephone Zip E-Mail if applicable Please provide me with a statement of my activity for the tax year s The following document s Please Check Win/Loss...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign choctaw win losses form

Edit your durant choctaw win loss statement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 74902 win loss form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit Choctaw Casino WinLoss or Tax Information online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Choctaw Casino WinLoss or Tax Information. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Choctaw Casino WinLoss or Tax Information

How to fill out Choctaw Casino Win/Loss or Tax Information Request

01

Visit the official Choctaw Casino website or the customer service desk to obtain the Win/Loss or Tax Information Request form.

02

Fill in your personal information such as your name, address, and Social Security number.

03

Specify the date range for the transactions you want to request (start date and end date).

04

Indicate if you need the information for personal records or for tax purposes.

05

Review all the information for accuracy and completeness.

06

Sign and date the form, verifying that all information provided is correct.

07

Submit the form either online, via email, or in person at a designated customer service location.

Who needs Choctaw Casino Win/Loss or Tax Information Request?

01

Individuals who have gambled at Choctaw Casino and need documentation for tax purposes.

02

Players who want to track their gambling activities over a specific period.

03

Anyone who has incurred significant losses or winnings and needs official records for financial planning.

Fill

form

: Try Risk Free

People Also Ask about

Is a win loss statement the same as a W2G?

A W2-G is an official tax document that is issued for individual jackpots and other gaming winnings over a certain amount; you should be given a copy of this form at the time the winnings are awarded. This is not the same as an annual win/loss statement.

How does a win loss statement from a work?

A Win/Loss statement is a report that provides an estimated play (amount of money that is won and loss) for the calendar year based when a Players Club card is properly inserted into the gaming device during play.

Does IRS accept win-loss statements from s?

You may deduct gambling losses only if you itemize your deductions on Schedule A (Form 1040) and kept a record of your winnings and losses. The amount of losses you deduct can't be more than the amount of gambling income you reported on your return.

Is a win loss statement good enough for taxes?

The bottom line is that losing money at a or the race track does not by itself reduce your tax bill. You must first report all your winnings before a loss deduction is available as an itemized deduction. Therefore, at best, deducting your losses allows you to avoid paying tax on your winnings, but nothing more.

Do s send win-loss statements?

s offer a win-loss statement for their slot players that itemizes coin-in and coin-out, but vary in their player-tracking policies for other types of play. The will give you a copy of the gambling win, on Form W-2G and send a copy to the IRS.

How do you get a win loss statement?

You will directly request the WIN LOSS statement from the or gambling establishment. If you have received gambling winnings exceeding $600 during the tax year, the W-9 form will be sent to the gambling entity.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my Choctaw Casino WinLoss or Tax Information in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your Choctaw Casino WinLoss or Tax Information and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send Choctaw Casino WinLoss or Tax Information for eSignature?

Choctaw Casino WinLoss or Tax Information is ready when you're ready to send it out. With pdfFiller, you can send it out securely and get signatures in just a few clicks. PDFs can be sent to you by email, text message, fax, USPS mail, or notarized on your account. You can do this right from your account. Become a member right now and try it out for yourself!

Where do I find Choctaw Casino WinLoss or Tax Information?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the Choctaw Casino WinLoss or Tax Information in seconds. Open it immediately and begin modifying it with powerful editing options.

What is Choctaw Casino Win/Loss or Tax Information Request?

The Choctaw Casino Win/Loss or Tax Information Request is a form that gamblers can submit to request a summary of their gambling activity, including winnings and losses, for tax purposes.

Who is required to file Choctaw Casino Win/Loss or Tax Information Request?

Individuals who have engaged in gambling activities at Choctaw Casino and wish to report their winnings and losses for tax purposes are required to file this request.

How to fill out Choctaw Casino Win/Loss or Tax Information Request?

To fill out the request, you need to provide your personal information, including your name, address, and Social Security number, along with any relevant dates of play and details about the games you participated in.

What is the purpose of Choctaw Casino Win/Loss or Tax Information Request?

The purpose of the request is to provide individuals with an official record of their gambling activity, which can be used to accurately report income and losses to the IRS or for personal record-keeping.

What information must be reported on Choctaw Casino Win/Loss or Tax Information Request?

The form must report details such as total wins, total losses, the type of games played, dates of visits, and any other relevant gambling activity during the specified period.

Fill out your Choctaw Casino WinLoss or Tax Information online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Choctaw Casino WinLoss Or Tax Information is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.